Explore a Certificate of Deposit (CD) at Financial Plus Credit Union

Looking to lock in your money for an upcoming expense? Whether you are saving for 12 months or 5 years, a Certificate of Deposit (CD) may be right for you. A certificate is a time-bound savings option that allows you to deposit a certain amount of money, for a fixed period, at a specific rate. Since funds are locked in, you're guaranteed to receive the amount you locked in, along with earned interest at the end of the term.

4.18% APY Certificate of Deposit (CD) Special:

Limited time only! Open a certificate at 4.18% APY Certificate of Deposit (CD) Special at Financial Plus with a premium rate and watch your savings grow.

-

4.18% APY*

-

12-month term

-

$500 minimum

-

$100,000 maximum

-

New money only

What a certificate could be used for:

- Saving for a down payment on a house

- Funding a future vacation

- Paying for a wedding

- And more

Benefits of opening a certificate:

- Safety: Money is securely locked away

- Flexibility: Varying terms for your needs (up to 60 months)

- Predictability: Know the dividends you will earn on your money

How to open a certificate at Financial Plus:

- Open online by clicking the button below

- Stop into any of our locations and chat with a representative

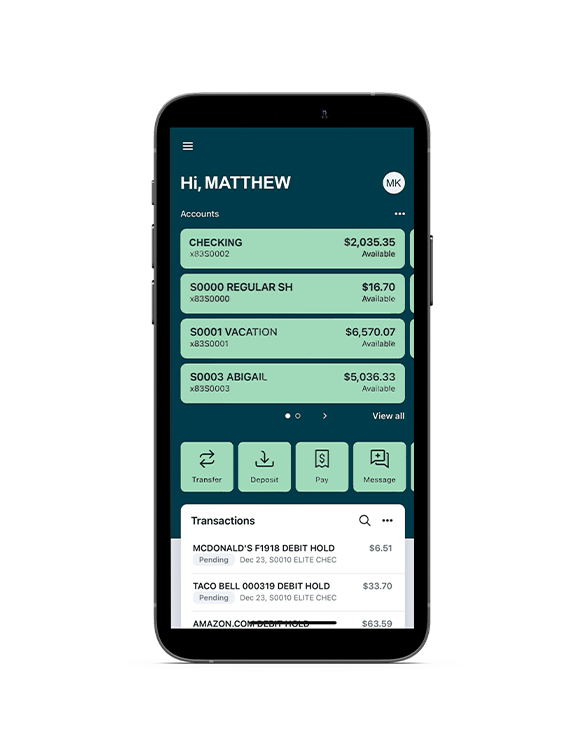

Easily manage your account

Sign up for digital banking in minutes online or at any branch location and download the mobile app to take us wherever you go.