Financial Plus Home Equity Loans:

$489 Processing Fee Waived

Your home's equity is the difference between its market value and the outstanding balance on your mortgage. This equity can be a valuable financial resource, especially when you need funds for major expenses like home renovations, your child's education, or consolidating high-interest debts.

For a limited time, you can save $489 with our waived processing fee!* That’s extra money in your pocket to put toward your needs. Don’t miss out on this valuable opportunity to maximize your savings while unlocking your home's potential.

Offer expires April 30, 2026.

Check in on your equity with HomeValue+

Want to stay informed about your home’s worth and available equity? HomeValue+ is a free tool in digital banking that provides real-time insights into your home’s value, available equity, and personalized financial offers.**

- Track your home’s value and changes over time

- View available equity at a glance

- Access personalized offers, such as home equity loans and refinancing options

What you get when you finance a home equity loan:

- Local mortgage expert to guide you through the process

- Competitive rates and no fees

- Borrow up to 95% of your home value

- Convenient payment options

Take the next step today and see how your home can work for you. Apply online or connect with one of our local mortgage experts to explore your options.

How to apply for a Fixed Rate Home Equity:

-

- Click the "Apply Online" button above

- Choose "Fixed Rate Home Equity"

How to apply for a Home Equity Line-of-Credit:

-

- Click the "Apply Online" button above

- Choose "Home Equity Line of Credit"

Important Terms of our Home Equity Lines of Credit >

You may find it helpful to gather the following items before you begin:

- Information about your existing mortgage loan (if applicable)

- Pay stubs or recent tax returns to reference current income

- Bank statements and retirement account balances for assets

Once your application is submitted, you will receive a confirmation email from our team. A Financial Plus mortgage expert will get in touch to review next steps within 1 business day.

heloc-calc

Advantages of Home Equity Loans

- Leveraging Your Home Equity: A home equity loan allows you to access the equity you've built up in your property. As you make mortgage payments, you reduce the principal balance, which increases your home equity. The advantage of tapping into this equity is that it provides you with a source of funding that typically offers lower interest rates compared to other forms of borrowing. Moreover, the interest on home equity loans may be tax-deductible, subject to certain conditions. This can make it a tax-efficient way to finance various expenses, such as home improvements, education, or medical bills.

- Lower Interest Rates: One of the primary benefits of a home equity loan is the interest rate. These loans typically offer lower interest rates than unsecured loans or credit cards. The reason for this is that a home equity loan is secured by your property. This lower interest rate can result in significant savings, especially if you're consolidating high-interest debts into a home equity loan.

- Flexibility in Use: Home equity loans offer flexibility in how you can use the funds. Whether you're planning a home renovation, need to cover unexpected medical expenses, or want to finance your child's education, the funds from a home equity loan can be used for various purposes. This versatility makes it a practical choice for homeowners with different financial goals.

- Predictable Monthly Payments: Home equity loans come in two main types: fixed-rate and variable-rate loans. A fixed-rate home equity loan provides stable, predictable monthly payments. This predictability can be advantageous for budget-conscious homeowners who want to ensure that their monthly financial obligations remain steady.

Timing Considerations for a HELOC

When considering a Home Equity Line of Credit (HELOC), timing can be crucial. The right time to get a HELOC depends on your financial goals and the current market conditions. Factors to consider include the interest rate environment, the purpose of the HELOC (e.g., home renovation, debt consolidation, or emergency fund), and your ability to manage the revolving credit line.

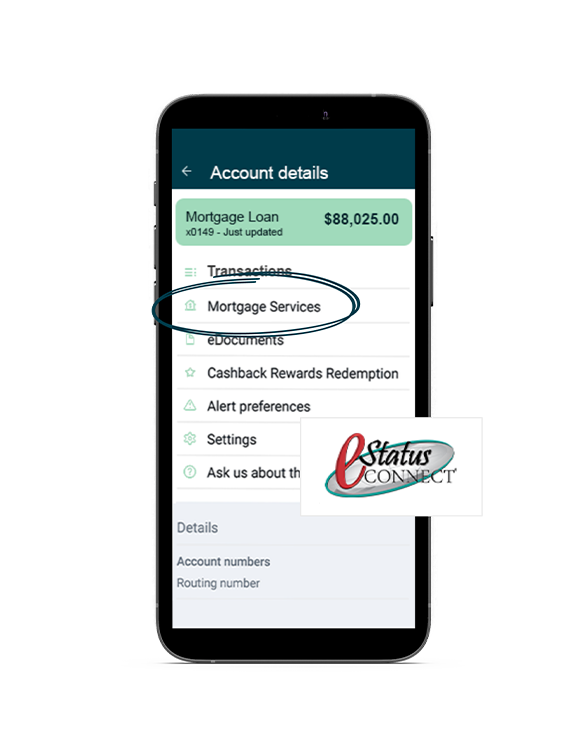

Managing your loan

Use eStatus Connect within your digital banking to make payments and view:

- Payment due date

- Payment history

- Current loan balances

- Previous and current year-to-date totals

- Upcoming interest and escrow changes

Home Equity Fixed

Use the equity in your home to access a lump sum of funds. These funds can be used for just about anything, including home improvements, paying off debt, and more. The rate is fixed, so your monthly payment won't change.

Applying is easy:

-

- Click the "Apply Online" below

- Choose "Fixed Rate Home Equity"

- Click the "Apply Online" below

Home Equity Line of Credit (HELOC)

Access the equity in your home whenever you need it with a HELOC. Works like a credit card, so as you pay down your balance fund become available again. Use a HELOC to renovate your kitchen, make a large purchase, and more.

Applying is easy:

-

- Click the "Apply Online" below

- Choose "Home Equity Line of Credit"

Solutions for every aspect of life

Mortgage Loan Officers and NMLS Numbers:

Financial Plus Credit Union - NMLS License #586579

Brooke Taylor-Huey, MLO - NMLS #642942

Rosemary Boan, MLO - NMLS #1531295

Amy Ricupati, MLO - NMLS #674678

Sherrie Dalton, MLO - NMLS #629441

Derek Lewis, MLO - #2335785

Rachelle Kippe, Senior Vice President and Chief Lending Officer - NMLS #423273

Marcia Dinauer, Mortgage Sales Manager – NMLS #855164

*Equal housing opportunity. Rates, terms, and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. Only valid for loans financed on or after October 1st, 2025. Processing fee valued at $489. Offer valid until December 31st, 2025. All loans subject to approval. See Credit Union for full details.

**Home Value+ is not an official appraisal and doesn't represent value for loan purposes. Your estimated equity does not represent a firm offer or approved loan amount. You must complete the application process to receive a firm offer or exact amount.