Financial Plus Auto Loans

Plus, whether you’re purchasing or refinancing, we’ve got even more savings options designed just for you:

Refinance |

Purchase |

Get 1% off your current rate

|

Get 1.00% off your next loan rate

|

Submit your auto loan application:

- Apply online by clicking the button below

- Stop into any of our locations and chat with a representative

Or, get started in less than 60 seconds:

Buying your first car? Check out our First-Time Auto Buyer Program:

Take the wheel with our First-Time Auto Buyer Program and make your dream of purchasing a car a reality. If you have limited credit, don't worry - you may still be able to finance an auto loan with us. Our experts guide you every step of the way, no matter what path you're on, and make the car-buying process smooth and hassle-free.

- Get up to $150 cash back after making your first payment^

- Discounted loan rates** just for being a member

- Assists young adults 18+ purchase their first car and establish credit history

- Flexible terms for affordable payments

- Easy online pre-approval in minutes

How to get approved for an auto loan:

- Apply online. We make it easy to apply for your new loan online. We may ask you for your social security number, proof of address, income, and proof of income, so be sure to have those documents ready.

- We’ll review your credit. Once we receive your application, we will review your credit and determine whether or not we can approve your loan and for how much. Your interest rate will depend on your credit history and other factors.

- Step into your new vehicle. We can quickly turn around loan approvals allowing you to drive off in your new car as soon as possible.

How much are our car loan rates?

At Financial Plus Credit Union, our low rates allow you to afford more features with lower monthly payments. Use our handy loan calculator to see how much you could save on auto finance.

Why choose Financial Plus Credit Union?

At Financial Plus Credit Union, we make it easy to get auto and home loans at some of the best rates in the industry. Once we do, we make it easy for you to manage these loans online and even offer money if you refer a friend. Contact us today to see why we are one of the top online credit unions.

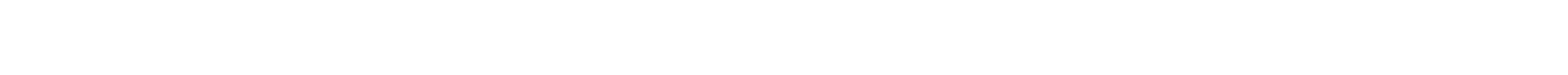

Easily manage your loan

Sign up for digital banking in minutes online or at any branch location and download the mobile app to take us wherever you go.

Solutions for every aspect of life

*APR = Annual Percentage Rate. Subject to approval based on creditworthiness. Rates may vary based on each individual’s credit history and underwriting factors. The Credit Union will reduce the rate of your existing non-Financial Plus loan by 1% (subject to a minimum rate of 3.99% APR for auto, 4.99% APR for boat, 5.49% APR for RV, and 5.99% APR for motorcycle and powersport loans). Proof of the current rate and terms of the loan to be refinanced is required. Promotion only applicable to secured auto, boat, RV, motorcycle, and powersport loans. Promotion does not apply to existing loans with the Credit Union, purchases or lease buyouts. Rates and terms are subject to change without notice. Cannot be combined with Loyalty Rate Discounts. The Credit Union reserves the right to modify or discontinue this offer at any time without notice. Some restrictions apply. See Credit Union for details.

^APR=Annual Percentage Rate. Refinances of eligible Financial Plus Credit Union loan(s) qualify for member discount at today’s rates. The Loyalty Discounts exclude lines of credit, Ready Now Loan, mortgage, home equity, and commercial loans. Direct Deposit of the payroll is required. If Direct Deposit and Auto Pay requirements are not maintained, you may be subject to a Direct Deposit/Auto Pay Cancellation Fee in the amount of $125.00. Loyalty Rate Discount is subject to change at any time. See Credit Union for complete details.