Helping Kids Save for the Future: Kids Club Savings Account

Whether they're saving up for their first bike, a special toy, or learning about the value of money, our Kids Club Savings account sets them on the path to a brighter financial future. We encourage savings by rewarding them each time they visit us and make a deposit with a free toy from our treasure chest.

When should I open a bank account for my child?

The ideal time to open a kids bank account or kids savings account can vary, but generally, it's a good idea to start when your child is around 6-8 years old. This is an age where they can begin to understand the concept of saving and managing money. However, Financial Plus Credit Union offers accounts for kids of all ages, so you can open an account as early as you feel comfortable.

What you get with a Kids Club Savings account:

- First $10 deposit on us^

- Trip to the treasure chest each branch visit

- No monthly fees

- Easily transfer money to account in digital banking

Check out all of our savings account options >

How to open a Kids Club Savings account:

- For kids ages 0-12

- Open online in less than 3 minutes by clicking the button below

- Visit any branch and chat with a representative

Open an account online in less than 3 minutes!

Free financial coaching: Prepare for your child's education

Investing in your child's education is one of the most meaningful gifts you can give them. Let us be your partner in securing your child's future and ensuring they have access to savings and the best educational opportunities. Contact us to schedule your free financial coaching session and take the first step towards a brighter tomorrow for your child.

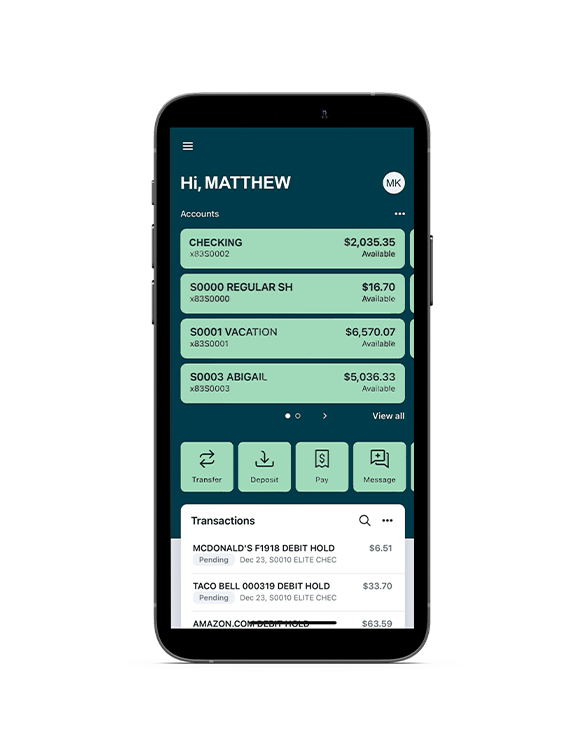

Easily manage your account

Sign up for digital banking in minutes online or at any branch location and download the mobile app to take us wherever you go.

Solutions for every aspect of life

^Must be new savings account relationship to receive $10 deposit. While supplies last. $10 deposit subject to 1099-MISC. Cash deposit will be made into savings account within seven business days of account opening. See Credit Union for complete details.

*APY = Annual Percentage Yield. Requirements apply to earn 4.15% APY. Dividends paid at month-end on daily balance up to $10,000. A 0.05% APY will apply to balances over $10,000. A 0.00% APY will apply in months where all requirements are not met. APY current as of 10/29/24. Rates subject to change. Limit one Go-To Checking account per primary member. Business accounts do not qualify. Some restrictions apply. See Credit Union for complete details.