.jpg)

4.00% APY* Youth Certificate at Financial Plus Credit Union

Big goals start with small steps—and saving early is one of the smartest moves you can make for your child. Whether it’s a first car, college tuition, or their first apartment, our Youth Certificate helps kids, teens, and young adults grow their savings with confidence. As a parent, you can support their future knowing every dollar is working toward something meaningful.

The Youth Certificate grows alongside them, offering steady returns, flexibility, and one withdrawal per 12-month term. You can regularly add money to their certificate, keeping their savings on track as they reach important milestones. Just contact us to set up your transfer options.

The sooner you open a certificate, the more their savings can grow. Give your child a head start on saving and building confidence with money.

Smart savings made simple:

- 4.00% APY*

- 12-month term

- No minimum balance required

- Available for ages 24 and under

What a certificate could be used for:

- First car

- College or trade school expenses

- Apartment, new home, or moving costs

- Travel or study abroad

- Wedding or engagement ring

- And more

Benefits of opening a certificate:

- Safety: Money is securely locked away

- Flexibility: Varying terms for your needs (up to 60 months)

- Predictability: Know the dividends you will earn on your money

How to open a certificate at Financial Plus:

- Open online by clicking the button below

- Stop into any of our locations and chat with a representative

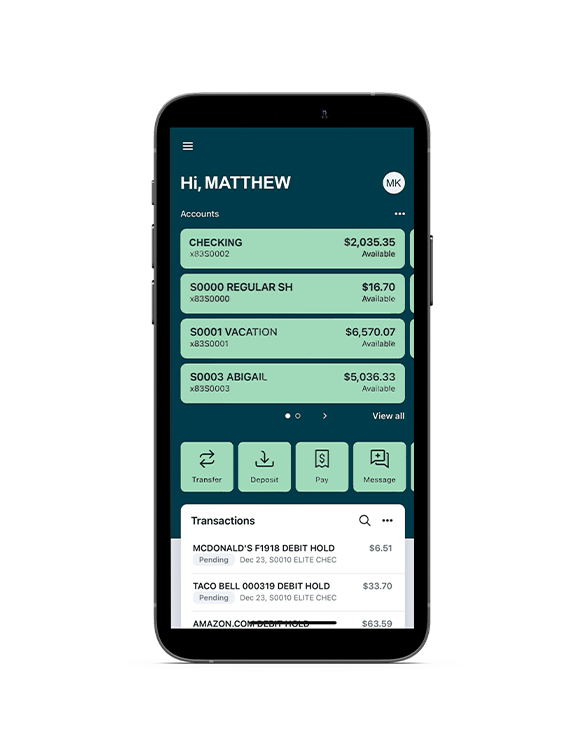

Easily manage your account

Sign up for digital banking in minutes online or at any branch location and download the mobile app to take us wherever you go.

Solutions for every aspect of life

*APY=Annual Percentage Yield. Insured by NCUA. 12 month term. Rate accurate as of 10/1/25 and subject to change. Available for ages 24 and under. Additional deposits may be made at any time during the 12 month term. One penalty-free withdrawal is permitted per 12-month term; additional withdrawals may reduce earnings and are subject to penalties. Certificate will automatically renew at maturity at the rate in effect at that time. FPCU reserves the right to cancel or modify the offer at any time. See Credit Union for complete details.